unlevered free cash flow vs free cash flow

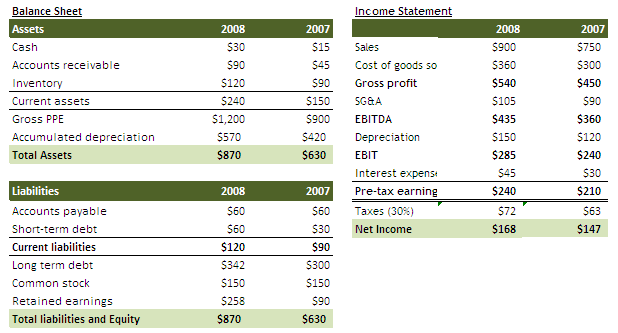

Think about these types of cash flow in terms of a before and after state. Unlevered cash flow is the amount of cash flow generated from business operations.

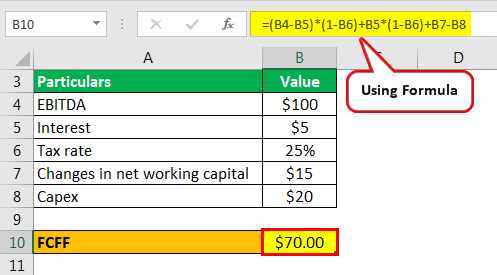

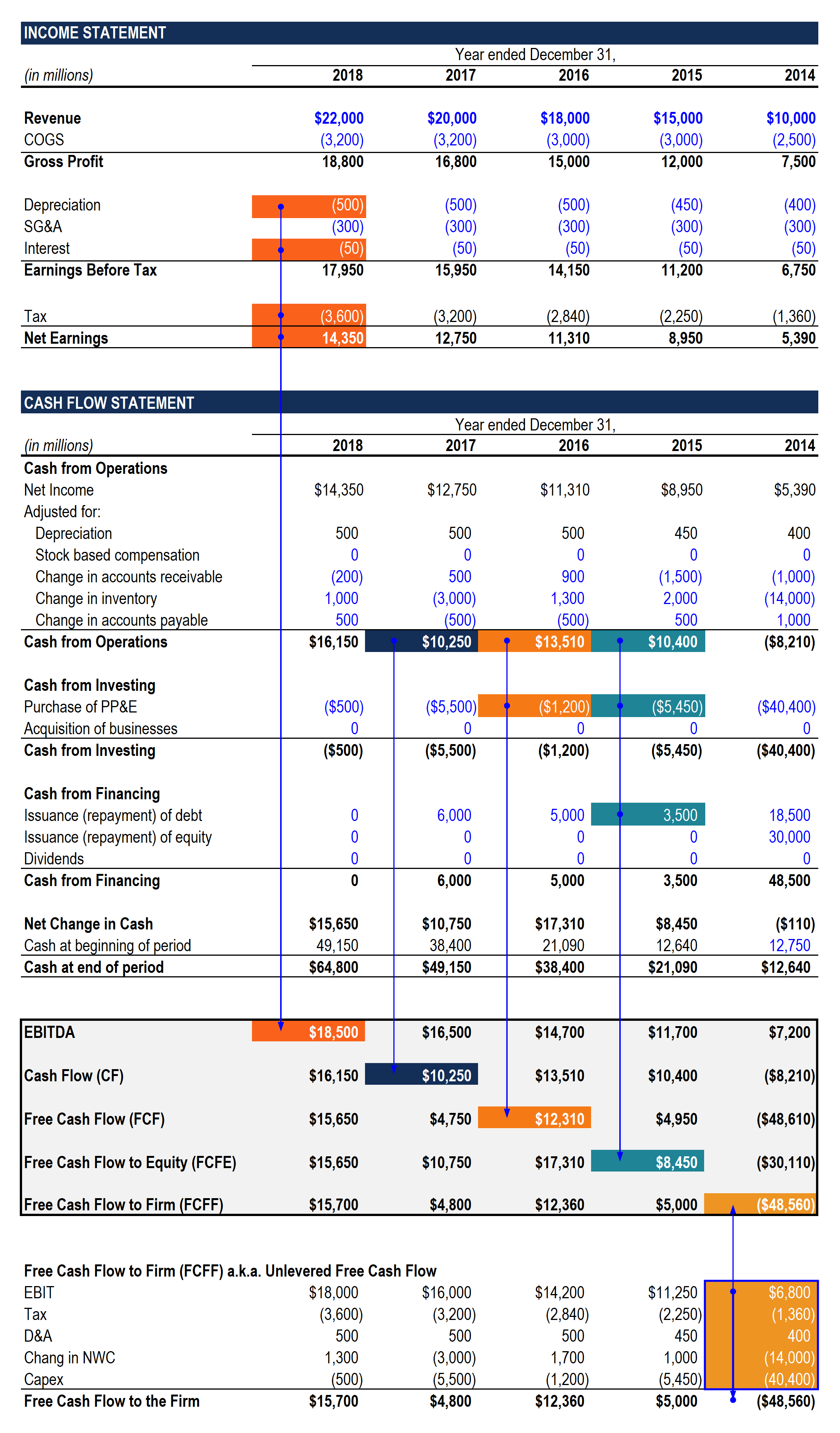

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Levered Free Cash Flow LFCF vs.

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

. 1 This is because it provides a. Unlevered free cash flow can be. A complex provision defined in section 954c6 of the US.

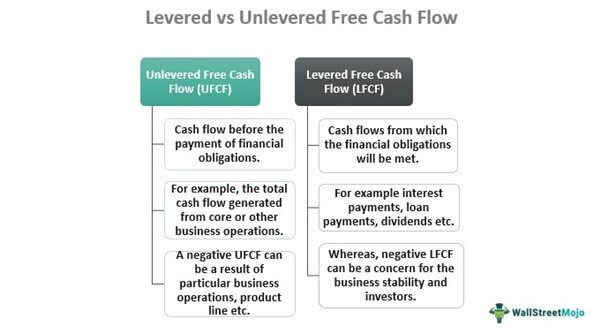

Unlevered Free Cash Flow - UFCF. The look thru rule. Unlevered Free Cash Flow UFCF Levered free cash flow LFCF is the amount of money a company has after deducting the amounts payable towards.

Levered cash flow vs. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. Unlevered cash flow vs.

Levered vs Unlevered Free Cash Flow. For this scenario unlevered free cash flow is the before state and levered free cash flow is the after. Free cash flow Levered cash flow is the amount of money your business has left over after paying all bills and other financial obligations including.

It represents cash available to all capital providers. Investment Banking Interview Guide Access the Rest of the Interview Guide 22 61 You can estimate that single number with this formula. Basic Definition of Levered FCF and Excel Demo 510.

Internal Revenue Code that lowered taxes for many US. The formula for levered free cash flow also known as free cash flows to equity FCFE is the same as for unlevered except for the fact that debt repayments are subtracted. Unlevered free cash flow.

Changes Required in a Levered DCF Analysis 1044. It excludes taxes capital expenditures and changes in non-cash. When it comes to analyzing the performance of a company on its own merits some analysts see free cash flow as a better metric than EBITDA.

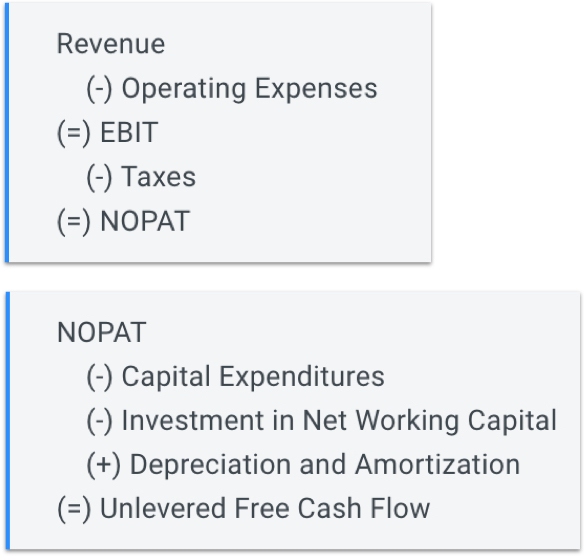

Unlevered Free Cash Flow is the cash generated by a company before accounting for interest and taxes ie. Unlevered free cash flow UFCF is an anticipated or theoretical figure for a business that represents the cash flow remaining before all expenses interest payments and capital. Terminal Value Final Year Free Cash Flow.

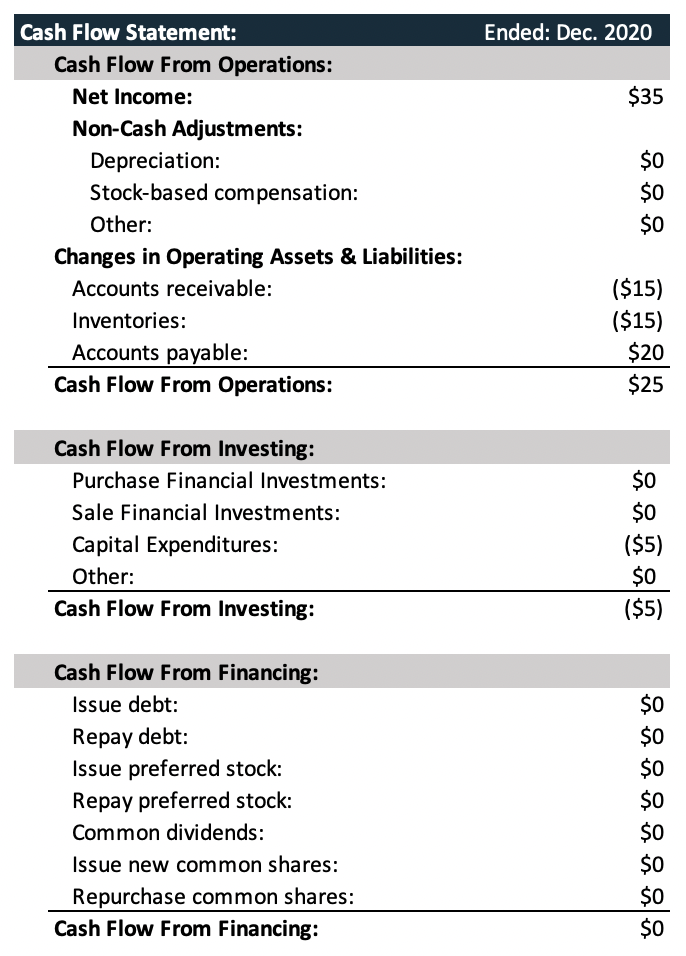

Operating Cash Flow or sometimes called cash from operations is a measure of cash generated or consumed by a business from its normal operating activities. Table of Contents for Video.

Levered Free Cash Flow Tutorial Excel Examples And Video

Fcff Vs Fcfe Top 5 Useful Differences With Infographics

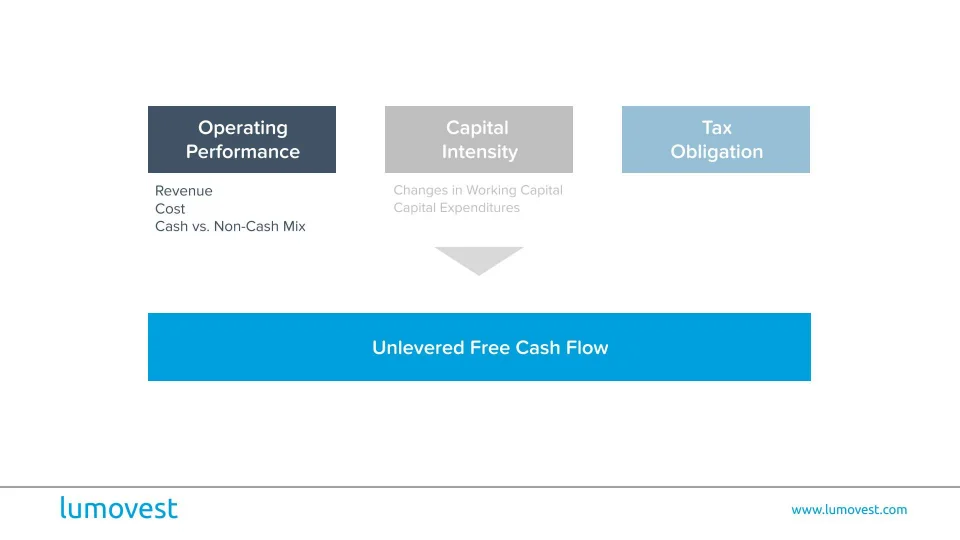

Drivers Of Unlevered Free Cash Flow Lumovest

Fcff Calculate Free Cash Flow To Firm Formulas Examples

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Unlevered Free Cash Flow Ufcf Formula And Calculator

Free Cash Flows Fcf Unlevered Vs Levered Financial Edge

Matthew Hogan Blog Estimating Domino S Pizza Free Cash Flow And Intrinsic Value Talkmarkets

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Levered Vs Unlevered Free Cash Flow Top 7 Differences

Fcfe Calculate Free Cash Flow To Equity Formula Example

Free Cash Flow Explanation Definition Calculation Speck Company

Free Cash Flow Levered And Unlevered Free Cash Flow Bankingprep

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Unlevered Free Cash Flow Ufcf Meaning Formula Example

Levered Free Cash Flow Tutorial Excel Examples And Video

Net Profit Ebitda Operating Cashflow And Free Cashflow In Dividend Investing

Free Cash Flow Fcf Most Important Metric In Finance Valuation